You are Leaving our website!

This link will be taking you to the Saint Lucie County Clerk & Comptroller website to learn more about their Property Fraud Alert Program.

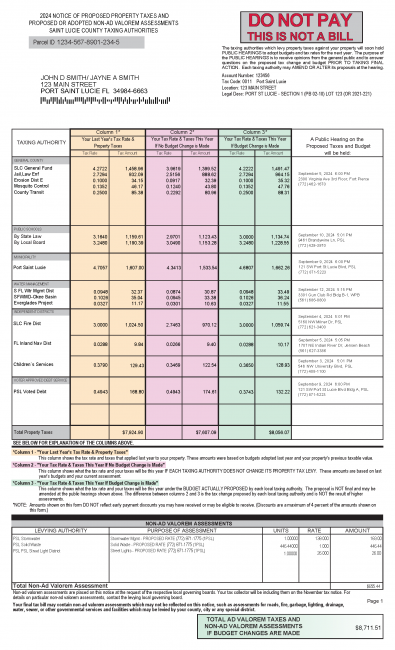

TRIM is the acronym for TRUTH IN MILLAGE and reflects the official Notice of Proposed Property Taxes.

Required by Florida law, the Property Appraiser mails this notice mid-August, annually, to the owner on record of every property in Saint Lucie County. Though this notice is not a bill, it is very important. It is an estimate of your property taxes based on the proposed millage (tax) rates, your property value as of January 1 of that year and any applicable exemptions for that tax year.

The TRIM Notice provides information on the proposed millage rates and estimated taxes for each individual Saint Lucie County taxing authority, including: the County Commission, School Board, the Municipalities, and other taxing districts. It also provides dates and times the taxing authorities will hold their public meetings to discuss tentative budgets.

The TRIM Notice also provides a deadline date in which to file a formal appeal with the Value Adjustment Board (VAB) if you disagree with the estimated Market Value of your property, Classification, or an Exemption as determined by the Property Appraiser. The deadline to file a petition this year is September 13, 2024.

Column 1 highlighted in orange, shows values as they were applied last year, based on previous year budgets and previous taxable value of your property. This is for your comparison purposes only, as the tax roll for last year has been certified and closed.

Column 2 highlighted in pink, shows what your taxes could be this year if each taxing authority chooses to generate the same amount of property tax revenue which was approved for the prior year. These rates and resulting taxes are based off last year’s budgets and your current property assessment.

Column 3 highlighted in green, shows the proposed rate and resultant taxes if each taxing authority adopts their proposed rate. These amounts are not set in stone as the exact budget may change after public hearings. Dates, times, and contact numbers are advertised in the next column.

In the public hearings column, each taxing authority provides a scheduled budget hearing date, time, and contact information. If you have any questions, concerns, or wish to discuss the amount or use of taxes, we strongly encourage you to attend the hearings, or call your local taxing authority.

On Page 2, the market value of your property, for both the prior year and the current year highlighted in yellow. Keep in mind that this is the value of the property as of January 1, for taxing purposes.

Below this is another table that once again shows the various taxing authorities on the leftmost column with the assessed value of the property from the previous year and the current year highlighted in pink. It includes columns for the exemption amount applied for the previous year and the current year highlighted in blue, if any, and the property’s taxable value recognized by each taxing authority for the prior year and the current year highlighted in green.

Next, you will see any assessment reductions/portability highlighted in purple on your taxes. Listed here are the values of any assessment reductions, such as Agricultural Classification and 3% or 10% capped benefit. If you applied and received a “Save Our Homes” cap portability benefit, this benefit will be reflected in this section as well.

Likewise, any exemptions this property benefited from for both this year and last, will be listed here and highlighted blue.

If you have questions about the value of your property or the exemptions applied we welcome you to contact our office at 772.462.1000.

Annually properties are reassessed on January 1. If you purchased your property in 2024, it has been reassessed. All exemptions, along with a property cap(s) from the prior owner, have been removed, which may result in an increased property tax bill. Property taxes are subject to change upon change of ownership.

You can find the assessed value of your property and the exemptions applied to your property on Page 2 of your TRIM Notice. You may also visit Search By Real Estate to view this information listed on your Record Card under the Value tab.

A few different factors could contribute as to why your neighbor’s taxes are lower than yours.

One is the ”Save Our Home” cap, which limits any annual increase in the assessed value of the residential property with a Homestead Exemption to 3% or the amount of the Consumer Price Index, whichever is less. You can only begin to accumulate this benefit after filing for and being granted a Homestead Exemption, providing the market value increases over time.

Another factor is your neighbor may be eligible for additional exemptions on their homesteaded property. We welcome you to visit About Exemptions to view the full list of exemptions.

If you have a Save Our Homes Cap benefit it will be identified on Page 2 of your TRIM Notice. The value will be highlighted in purple. You start to accrue a Save Our Homes Cap after your first year of Homestead Exemption given the market value increases over time.

View your Portability/Assessment Reductions benefit on Page 2 of your TRIM Notice. The value will be highlighted in purple.

Ad valorem taxes are taxes whose amount is based on the value of property, exemptions, caps, and the millage rate set by each taxing authority.

Non-ad valorem assessment are special assessments or service charges which are not based on the value of the property. Non-ad valorem assessments are assessed to provide certain benefits to your property including services such as landscaping, security, lighting, and trash disposal.

The Saint Lucie County Property Appraiser’s Office determines the value of your property based upon the current real estate market.

To find the value of any piece of property, the Property Appraiser’s Office must first know what properties similar to it are selling for, what it would cost today to replace it, how much it takes to operate and keep it in repair, what income it earns, as well as other facts affecting value.

The Property Appraiser’s Office has not created value; people create value by their transactions in the marketplace.

The Property Appraiser’s Office has the legal responsibility to study those transactions and appraise the property accordingly.

To find your TRIM Notice on www.paslc.gov, click Search by Real Estate. Then search for your property by the site address, Parcel ID, or your name. When your property populates click on the teal TRIM button to view your 2024 TRIM Notice.

The tax rate refers to the millage approved by your local taxing authorities. It is used to calculate your ad valorem taxes. One mill equals $1 for every $1,000 of taxable property value.

You will find the proposed millage rates on Page 1 of your TRIM Notice along with information about when the taxing authorities will be holding public hearings for their budget.

Clerk of Court: Provides official records of property ownership changes.

Property Appraiser: Determine the value of all property and administer exemptions for tax purposes. The Property Appraiser does not determine the amount of taxes you pay.

Taxing Authorities: Determine how much money is required to provide services and establish the tax (millage) rates annually.

Tax Collector: Sends the tax bills in the beginning of November and collects the taxes.