The Appraiser’s Role

Constitutionally, the Property Appraiser is charged with the duty and responsibility of placing a fair, equitable and JUST value on all real and tangible personal property in Saint Lucie County. Real property includes land and all buildings, structures, and improvements to the land. Tangible personal property includes machinery and equipment, fixtures, furniture, and other items owned and used for business purposes. To ensure that equality of valuations is achieved, we employ a system of property appraisal based on modern, sound, and nationally accepted appraisal practices and principles. Valuations are kept up-to-date and are part of the permanent records of this office. As such, they come under Florida’s Public Records Law and are available for your inspection.

In addition to appraising property, the Property Appraiser tracks ownership changes, maintains maps of parcel boundaries, administers homestead, widow’s and disability exemptions, property entitled to agricultural classification and determines the eligibility of certain religious, charitable, educational, municipal property for tax exemption. These duties are accomplished through four main departments: Appraisal, Mapping, Tax Roll and Tangible Property.

The Property Appraiser’s Office does not set your taxes. The cost of providing public services determines your property tax. This is done by your elected county and city officials, your School Board and other tax districts such as fire, roads, port & airport and water management. They set tax rates to produce the necessary money to fund the budgets that provide the services you use. Additionally, taxes are collected to pay for special voter approved bonds and municipal services.

The Appraisal Process

The Saint Lucie County Property Appraiser’s Office determines the value of your property based upon the current real estate market. To find the value of any piece of property, the Property Appraiser must first know what properties similar to it are selling for, what it would cost today to replace it, how much it takes to operate and keep it in repair, what income it earns, as well as other facts affecting value. The Property Appraiser has not created value; people create value by their transactions in the marketplace. The Appraiser’s Office, simply, has the legal responsibility to study those transactions and appraise the property accordingly.

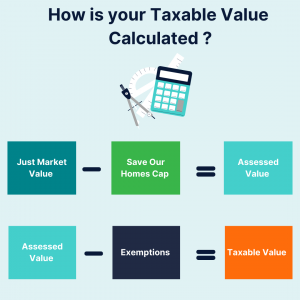

How Taxes are Determined

Yearly, taxing authorities decide how much tax money their budgets require to operate and provide public services. Public hearings are held giving taxpayers the opportunity to participate in the process. The Property Appraiser determines the total assessed value of all taxable property. A tax rate or millage rate is calculated by dividing the amount of tax to be raised by the total assessed value. The taxable value of your home ( total assessed value less any applicable exemptions) is then divided by 1,000 and multiplied by the millage rate to arrive at the amount of tax due.

Amendment 10 (Save Our Homes)

Effective January 1, 1995, Amendment 10 to the Florida Constitution limits any annual increase in the assessed value of residential property with a homestead exemption to 3 % or the amount of the Consumer Price Index, whichever is less. When the property is sold, the new owner will be assessed at the current fair market value. Assessment limits will apply beginning the year after the property has received a new Homestead exemption.

Exemptions

Persons who have legal or equitable title to real property in the state of Florida, occupy it, and make it their permanent residence as of January 1 are eligible for a homestead exemption.

There are additional exemptions available based on eligibility such as an unremarried widow or as a person with a disability. See the exemptions page for details on these exemptions.

Applications for homestead, widows, or disability exemptions can be filed online or in person at one of the Property Appraiser’s Office locations. All initial applications and renewals must be made between January 1 to March 1 of each year. Pre-filing for homestead, however, may be made at any time for the succeeding year.

Homestead exemption is not transferable. You must make a new application if you received an exemption last year but established a new residence as of January 1 or if there has been a change in the title such as trust or adding a spouse to the title.

About PASLC

About PASLC Property Search

Property Search Exemptions

Exemptions Tangible Personal Property (TPP)

Tangible Personal Property (TPP) Public Records Request

Public Records Request FAQ's

FAQ's Recording A New Deed

Recording A New Deed Contact

Contact